Contents

- Legal expenses insurance

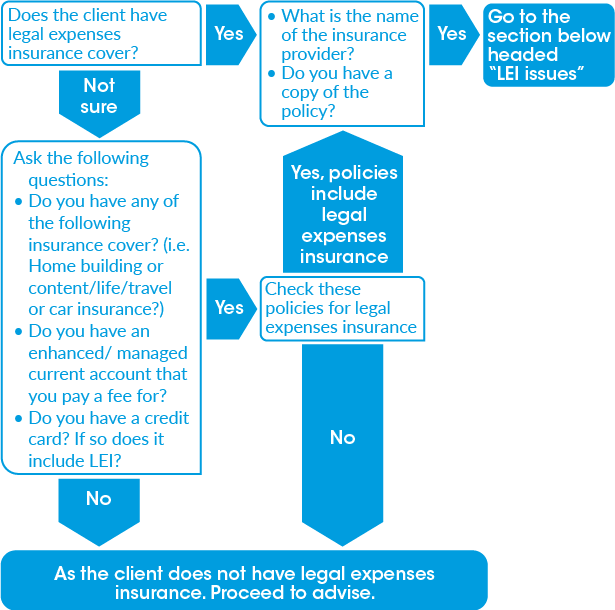

- Legal expenses insurance flow chart

- Legal expenses insurance issues

- Sources of rules

- Resources and downloads

A pdf version of this guidance is available for download at the bottom of this page.

Legal expenses insurance

At the first contact with clients advisors should establish whether they have legal expenses insurance (LEI) or Before the Event insurance. LEI covers legal costs in respect of certain legal issues and/or disputes.

If clients have a LEI policy they might be entitled to have their legal problem dealt with by solicitors instructed by their insurer, with the costs being met by the insurer. Whether LEI covers a client’s legal problem will depend on the policy terms. Where clients have LEI, generally, clinics should advise clients to seek representation by making a claim against their policy.

Advisors beware: taking any step in a dispute, including writing a letter to an opponent, could, subject to the terms of the LEI, forfeit entitlement to insurance cover.

LEI is commonly included in:

- Motor insurance policies

- Credit Card contracts

- Household insurance policies

- Annual travel insurance

- Managed bank accounts

LEI typically covers:

- Personal Injury

- Consumer

- Property

- Employment disputes

- (Award of the other party’s costs)

Normally, any legal action for which the expenses are incurred must have a reasonable prospect of success.

Legal expenses insurance flow chart

Legal expenses insurance issues

What happens if the insurer refuses to fund the legal action?

If the insurer has rejected a claim then the insured person can either appeal and/or failing that, complain to Financial Ombudsman Service FOS (see: www.financial-ombudsman.org.uk)

If insurance cover has been denied or an appeal is underway, clients might wish to ask for an expert opinion to be drafted pro bono, via a clinic on LawWorks’ network.

What happens if the insurer agrees to fund the legal action?

Pre litigation stage

If the insurer considers that a claim should be pursued, the normal practice is for it to be passed to an external firm of solicitors on the insurer's panel. Legal expenses policies often give the insurer the freedom to choose which solicitors to appoint for advice and assistance up to the time where legal proceedings start - unless there is a conflict of interest. Insurers have panel solicitors whom they regularly instruct.

Will the insurer fund the client’s chosen solicitor to act BEFORE proceedings start?

Insurers sometimes have no objection to using a policyholder's own solicitor but insurers often prefer to use their solicitors from their own panel.

Sources of rules

The rules which apply to legal expenses insurance which advisors might wish to familiarise themselves is as follows:

- Legislation: Insurance Companies (Legal Expenses Insurance) Regulations 1990/1159

- Case law: Brown-Quinn & Anor v

Equity Syndicate Management Ltd & Anor

[2012] EWCA Civ 1633) - SRA rules: Rule 4.1 of the SRA Indemnity Insurance Rules 2012

- Financial Ombudsman Service: see FOS’ decisions